Background

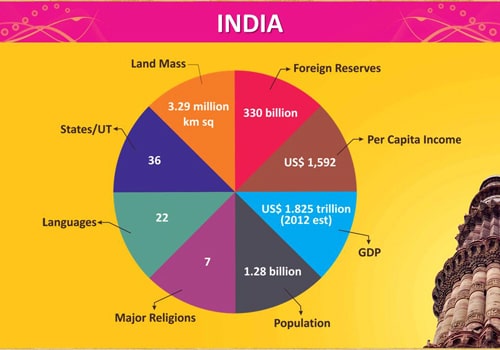

Background India has caught the attention of major Aerospace manufacturers and Engineering Companies with its low production cost and Indian Government’s strong focus on building manufacturing sector under “Make In India” initiative. India is also rated among the largest markets by internationally linked SME which plan to expand supplies to Indian customers or form Joint Ventures in the country to make their components for Exports. With the ‘Make in India’ initiative, APSPL’s Aerospace Team has been constantly focused on looking for new business opportunities for their Foreign Partners to collaborate with the Indian industry.

Business Case

The business rationale for a ‘Make In India’ JV constitutes primarily Jointmanship in Business Operations involving long-term strategic partnerships for sharing of technical/business knowhow. To a large extent, the issues which need to be resolved between potential JV partners depend on mutual appreciation of core competencies and the USP that each JV participant brings to the table, commercials and nature of the proposed JV and the Partner credentials. Potential Partners need to have these issues adequately forecasted and addressed to prepare well for a cordial and mutually enriching partnership. Some of the inherent challenges that would be encountered would include :-

These issues are often inherent in structuring a strategic alliance and may include:

- The relative values of technology and other assets contributed to a joint venture.

- The relative values of the ownership structure of the joint venture itself.

- The value of an investment by a corporate partner in a start-up entity in exchange for the use of the technology the start-up is developing.

- The value of the synergies in a marketing or distribution alliance.

- It is experienced that in JVs between companies of a foreign culture (American, French, British, German) and Indian companies, there is an inherent cross-cultural context, which is downplayed since there is no language barrier in discussions with the Indian partner, due to the pre-eminence of English as the language of business in India.

- Further, Indian partners are well travelled, good communicators in general and have high social skills, all of which provide a false sense of cultural comfort. The reality is that speaking the language is different from understanding each other. The two partners can finish a meeting with each other drawing opposite conclusions and interpretations of the same discussion.

- It’s not just language and communication— work ethic, value systems, corporate culture within teams and other cultural aspects are different too.

- Foreign companies are often large corporate entities with institutional ownership and professional managers while most Indian companies are family owned and family member-led.

- Typically, most managers focus on short- to mid-term goals to earn their bonuses and be recognized for promotions while a family has a longer-term view linked to shareholder returns. Further, foreign company managers change regularly, which creates uncertainty about the India strategy while the Indian family is more stable.

- Most foreign companies can access wider sources of capital and at a lower cost. They draw on market-driven banking partners, government funding agencies, tax incentives and other innovative sources of capital, which are not as accessible to many Indian companies. They access bank debt at interest rates that are 5-7% cheaper, although they may have to account for foreign exchange depreciation in the future.

- However, the Indian partner needs to fund the JV at a higher cost right from the start. Consequently, the Indian partner has a need for a shorter break-even period and a higher return on capital employed.

- Many JVs are with new Start-ups and MSMEs. Even in acquisition-driven JVs, the challenge is to develop new lines of business. This calls for the ability to invent or reinvent. Many large foreign companies are no longer entrepreneurial and are run by managers who didn’t build these businesses. They tend to over-research and over-plan for all scenarios.

- While the Indian company has a strong entrepreneurial culture, Indian partners come with the background of recent success in their core business and have a “know-it-all” attitude. They are unwilling to invest in a step-by-step approach to establish a new business.

- Both partners want control. It’s natural since each feels that it is investing time and money. The foreign company is insecure about giving its brand and technology, and the Indian company worries about its financial investments. Yet, businesses need clear defined leadership structures to succeed.

- Most people have a “Win-Lose” approach to doing business with outsiders and they encourage the same culture within their teams.

- The respective “Win-Lose” behavior of each of the JV partners affects important decisions where what’s best for the JV may not be best for one’s company. Some examples are product strategy, industrial strategy, financial strategy and many others.

- This creates an environment where trust and transparency are lacking. Further, negotiating strategy of the two partners is different and based nearly always on a “Win-Lose” approach.

APSPL Approach

While APSPL acknowledges challenges in JV work-outs and works with prospective global JV Partners to manage them through the birth and lifecycle of a ‘Make In India’ JV, APSPL’s experts leverage their ‘Make In India’ expertise in Demographic Advantage, Infrastructure, Incentives for manufacturing, Govt Initiatives & Budgets for promoting Manufacturing, Ease of Doing Business, Skill India, Sector opportunities in Aerospace and Engineering, to provide Partner teams with the necessary flexibility to appreciate the terms & conditions of a mutually beneficial JV, resulting in strong, effective deals.

Outcome

APSPL Approach APSPL acknowledges challenges in JV and works with prospective global JV Partners to manage them through the birth and lifecycle of a ‘Make In India’ JV. APSPL aims at long-term success for its JV Partners by helping agreement processes that are transparent and follow patterns of conversation established from the outset. At its core, this simply means communicating with all parties about how, when, and what to communicate.

- Designing transparent agreement processes

- Establishing clear communication patterns

- Aligning expectations of JV Partners

- Focusing conversations and reducing delays

- Expertise in ‘Make In India’ initiative

- Commitment to long-term relations, financial advisory and direct investments.